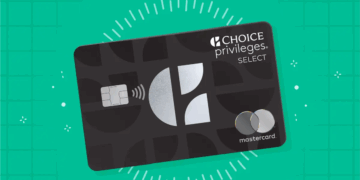

How to Apply for the Choice Privileges Select Mastercard Credit Card

The Choice Privileges Select Mastercard Credit Card offers enhanced reward points for Choice Hotels stays, no foreign transaction fees for international purchases, and waives the first-year annual fee. Plus, enjoy exclusive discounted rates on hotel bookings, making travel more rewarding and economical.

How to Apply for Emirates Skywards Premium World Elite Mastercard

Unlock remarkable travel benefits with the Emirates Skywards Premium World Elite Mastercard. Earn triple Skywards Miles on Emirates flights and 1.5 miles on everyday spending. Enjoy complimentary global lounge access, Silver Tier status, and no foreign transaction fees, enhancing travel comfort and financial ease worldwide.

How to Apply for Delta SkyMiles Platinum American Express Credit Card

Unlock travel perks with the Delta SkyMiles Platinum American Express Card. Earn 3X miles on Delta purchases and enjoy an annual free companion fare. Achieve elite status faster with Status Boost and relish in discounted Sky Club access. Plus, save with your first checked bag free for up to eight companions.

How to Apply for the M1 Owners Rewards Credit Card Easily

The M1 Owner's Rewards Credit Card offers up to 10% cash back with select companies, has no annual fee, and integrates with M1 Finance for seamless investment opportunities. Enjoy flexible spending power with competitive APR rates, ideal for aligning expenses and maximizing long-term financial growth.

Thematic ETFs vs. traditional stocks: which is more worthwhile?

This article explores the pros and cons of thematic ETFs versus traditional stocks, highlighting how each investment type aligns with personal values, risk tolerance, and financial goals. It emphasizes the importance of understanding these options to make informed decisions that resonate with individual aspirations and contribute to a meaningful financial journey.

How to Balance Risk and Return in Your First Investments

Navigating the investment landscape requires understanding the relationship between risk and return. Assessing your risk tolerance and building a diversified portfolio are crucial steps. Developing a personalized strategy, staying informed, and maintaining emotional discipline will empower you to make informed decisions and achieve your financial goals.

Investment tips for those who want to retire early

Discover essential investment strategies to achieve early retirement. Emphasizing the importance of starting early, understanding compound interest, diversifying your portfolio, and utilizing tax-advantaged accounts, this guide offers actionable tips to help you take control of your financial future and turn your dream of financial freedom into a reality.

Stocks vs. ETFs: which is easier to understand and manage?

The article explores the differences between stocks and ETFs, highlighting their unique characteristics, complexities, and management styles. Stocks offer potential high returns but require diligent research, while ETFs provide built-in diversification and simplicity, making them a more approachable choice for new investors. Ultimately, the best option aligns with personal financial goals and comfort levels.

How to Build a Resilient Portfolio Against Market Risks

This article explores strategies for building a resilient investment portfolio that withstands market volatility. Emphasizing diversification, regular rebalancing, and effective risk management, it encourages proactive financial education to empower investors in navigating uncertainties and achieving their long-term financial goals with confidence.

What to Consider When Creating a Personalized Retirement Plan

This article emphasizes the importance of creating a personalized retirement plan by considering lifestyle aspirations, setting financial goals, and factoring in healthcare costs. It advocates for continuous monitoring of your budget and financial strategies while seeking professional guidance to ensure a secure and fulfilling retirement.